Yesterday Apple released their 2013 Q4 numbers and spoiler alert – they sold a lot of stuff. Specifically, they sold a lot of iPhones, iPads, iPods, Macs, and iTunes content, providing specific sales numbers for each of these categories. What wasn’t detailed is how many Apple TV’s were sold.

Very little is done without a reason at Apple, and the lack of clear communication surrounding the Apple TV may well be strategic. The last announcement of Apple TV sales was in May 2013 at the D11 conference, when Tim Cook stated that 13 million had been sold, with half sold in the prior year. Eight months have passed, and assuming the sales have held somewhat steady, it’s difficult to see how Apple can justify calling a product that has sold in the neighborhood of $2 billion a “hobby.” So why the silence?

Perhaps it’s time for Apple to “disrupt” the television space. If that is the plan, they are doing it in a classic Apple way, quietly building an installed base of around 20 million Apple TV’s. While that number pales in comparison to the number of iPhones, iPads, and iPods, it is a fairly significant number of larger screens. Let’s put it in perspective:

The top 5 US cable companies are:

Based on market share (numbers of subscribers)

Currently – January 2013 (numbers are approximate)

1. Comcast Corp.: 23 million

2. Time Warner Cable: 12 million

3. Cox Communications: 4.595 million

4. Verizon: 4.592 million

5. AT&T: 4.3 million

[source: Wikipedia]

Apple now has nearly the power of Comcast in terms of subscribers to their television service, and just like they did with music, they are going to the content producers instead of the retailers. Think of PBS, ABC, Disney, and HBO as analogous to the music labels, and Comcast and TW are today’s Blockbuster Video. Give the customers what they want, at a reasonable price, and remove players that add no value.

Everyone hates their cable company. Everyone. They are “safe” today for one reason and one reason only – most of the content producers are contractually tied to only offer much of their content only to paid cable subscribers. That is why most of the Apple TV “networks” require you to sign in to AT&T or COX before you can view live content, although we are seeing a trend to offer more and more content without this login requirement where possible.

As Apple reaches critical mass, they will have the same negotiating power that Comcast has, and those contractual handcuffs will fall by the wayside. The content producers will quickly realize that, in order for them to survive, they can’t ignore 20 million TV’s and 700 million smaller iOS screens that Apple brings to the table. Those numbers make Comcast seem pretty insignificant in comparison, and if they aren’t scared, they should be.

The other disrupting force in this market is Netflix. By provoking exclusively on-demand content, and branching out into original productions, Netflix has grown to 33.4 million subscribers, certainly giving HBO and Showtime pause. Netflix is able to build a direct relationship with its customers, and leverage rapidly evolving technology to satisfy their early-adopter customers and support 4K years before the cable TV companies will have upgraded their infrastructure. The combination of Apple TV and Netflix will force HBO and Cinemax to make changes to their business model, and that combined pressure will become an unstoppable force forward.

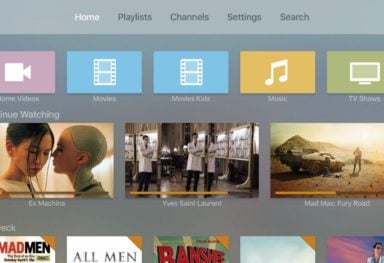

Apple has created a premium market and product suite for entertainment. Music, movies, books, and casual games exist on large part with Apple as one of, if not the, primary market and source of revenue for many developers and content producers. To date, Apple has limited Apple TV gaming to AirPlay from another iOS device or, more recently, OS X. So the final interesting possibility here is the A7 chip and it’s 64-bit capabilities. Few would argue that the iPhone 5S and iPad Air are unable to make full use of this chips possibilities, primarily due to power and space concerns. When these constraints are removed, the gaming possibilities of this platform become very interesting as well. Rumors are circulating, as they have before, that Apple is going to release an Apple TV SDK and open the platform to developers.

Apple has been quietly adding select content providers to their Apple TV ecosystem. This has allowed them to accomplish a few specific goals: stay under the radar of the cable providers, allow the device to gain more marketshare and approach that “critical mass,” and mature their API in infrastructure. There is a very big difference between selling a 4-minute song and streaming live video to tens of millions of devices. But don’t think for a second they they don’t have a plan and that they will, as they have done time and time again, disrupt an entire industry in the guise of releasing a product.

It’s what they do.

Comments

Be The First to Comment